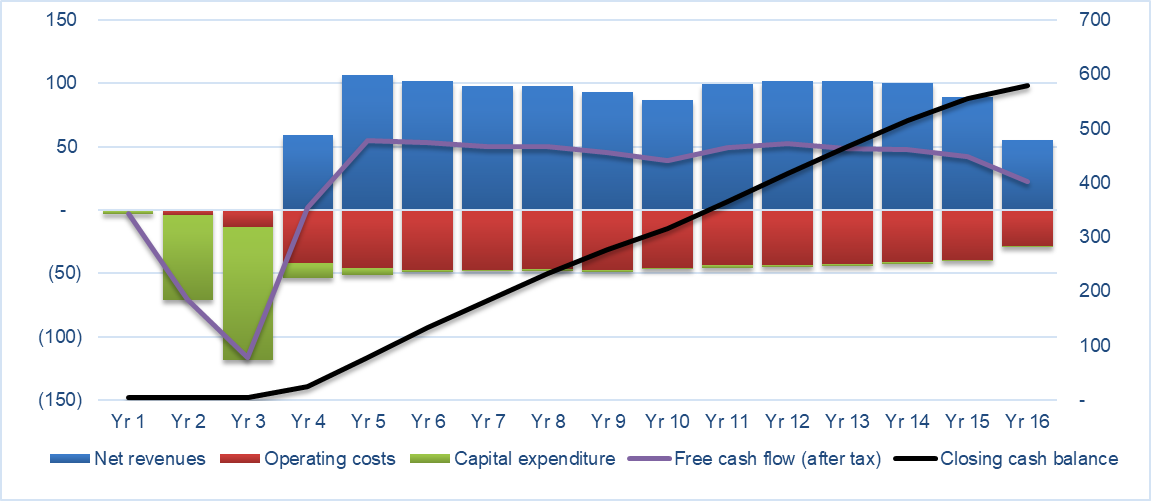

A mine operations life of 12 years 9 months and heap leach operations life of 12 years 11 months leads to no major replacement or rebuilds being necessary on major equipment. Sustaining capex needs for the project are dominated by the ongoing costs of expanding and managing the Heap Leach Facility.

The mining activities related to earthmoving will be undertaken by an equipment supply contractor under the direction of the Company. Other specialist activities such as Blasthole drilling and supply and delivery of explosives to the field will be contracted to specialist service providers. The mining LOM cost is forecast to be $3.47 per tonne of material mined or $0.64 per pound of copper produced inclusive of mine geology and ancillary mining activities.

The LOM processing costs equate to $6.58 per tonne ore stacked or $0.69 per pound copper produced, with the most significant cost being electricity consumption. Power is now proposed to be sourced from the development of a new, dedicated coal-fired power station located on site at BKM. The study cost model adopts a build, own, operate and maintain model provided by a third-party supplier with current estimates delivering a unit cost of 14c per kilowatt hour.

General and Administration costs include transport and logistics (contracted), site camp services (contracted), Supply Chain Management, Information Technology, Environmental, Sustainability and Governance and overhead administration activities. The LOM unit cost of these activities in the financial model is $4.42 per tonne ore processed or $0.46 per pound copper produced.

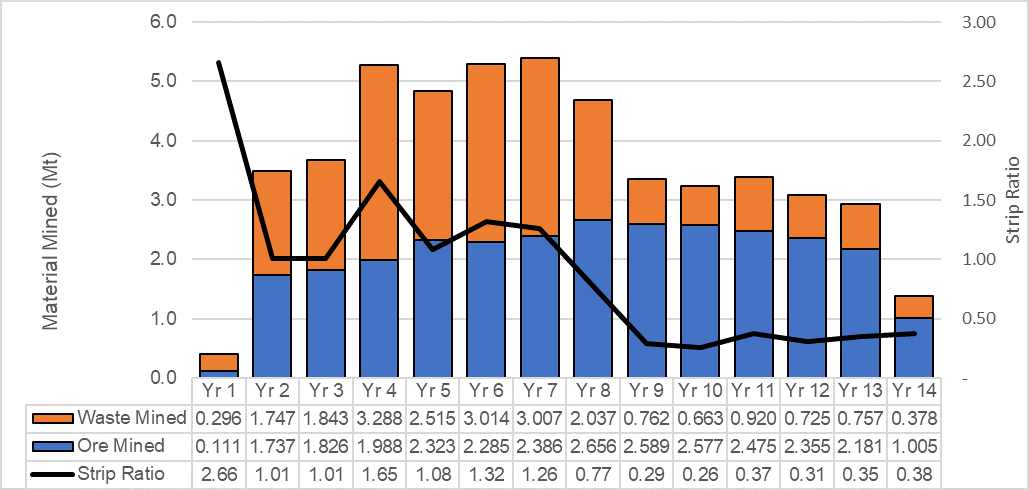

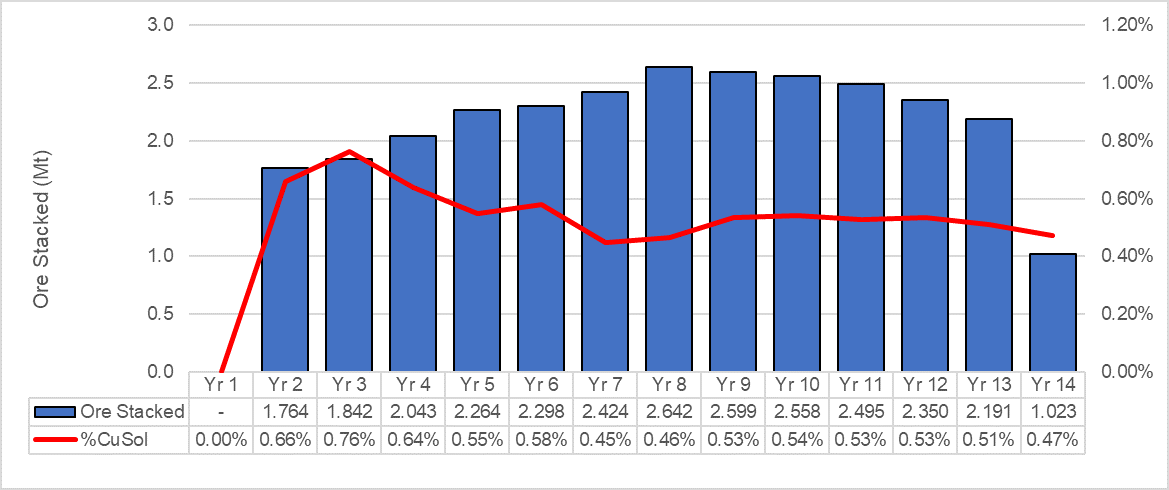

The charts below show the Life of Mine (LOM) production (Figure 1) and Ore delivered to the heap leach facility along with Soluble Copper grade (Figure 2). Ore mined is slightly lower in years 1-3 as higher grades of soluble copper are mined first delivering strong early-stage cash flows to the project. The LOM strip ratio is low at 0.77:1, aiding the profitability of the project.